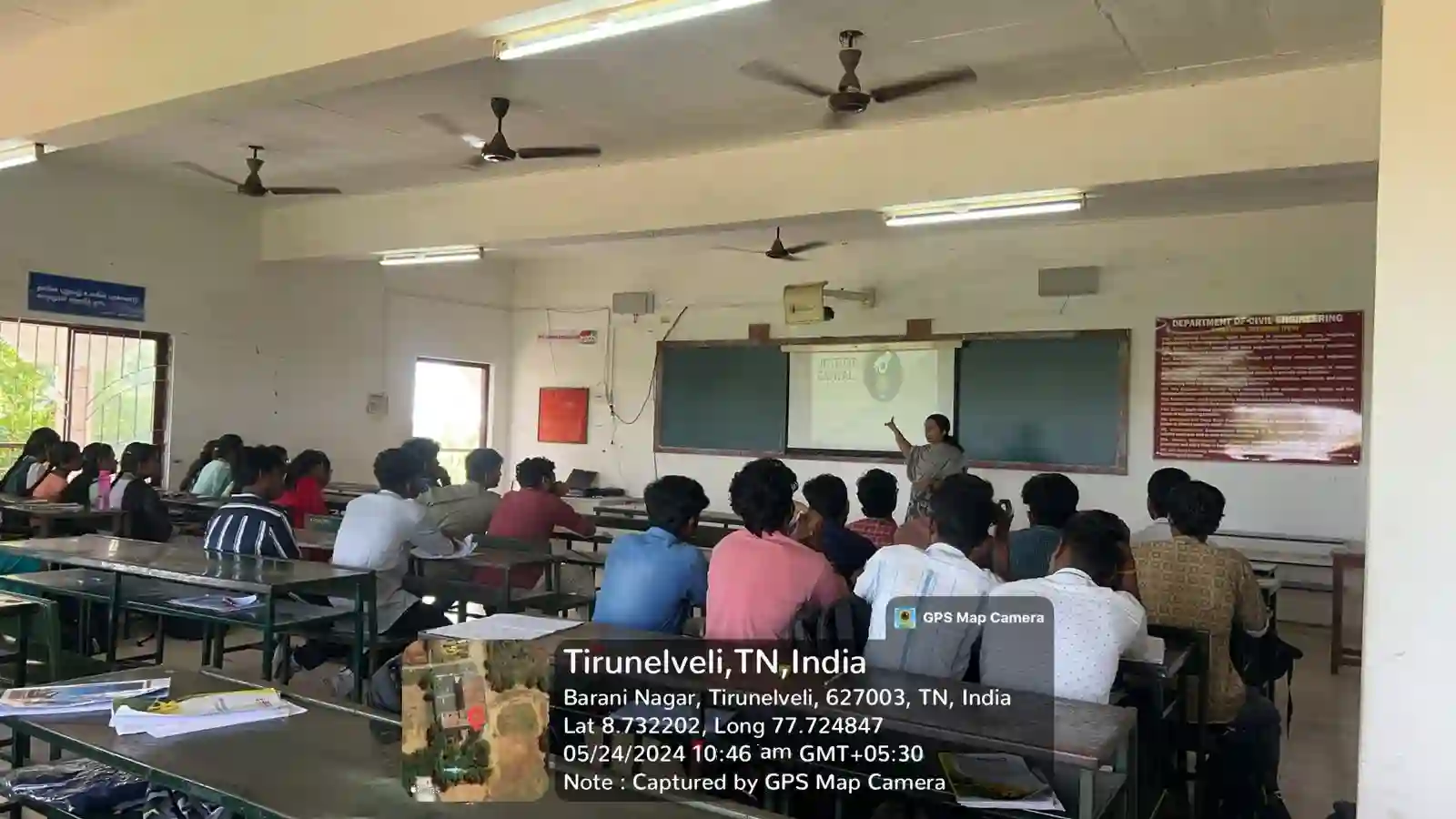

On 24th May 2024, Entrepreneurship Development Cell and IIC in association with Department of Civil Engineering organized a Session on Angel Investment/ Venture Capital Funding Opportunities for Early-stage Entrepreneurs. The resource person for the program was Ms.P.Thamizh Paavai, Assistant Professor, Department of English, Francis Xavier Engineering College, Tirunelveli. 41 Civil Engineering students and 1 faculty attended the program. The session was coordinated by Mrs. P. Raja Priya, Assistant Professor, Department of Civil Engineering, FXEC.

The resource person explained the main objectives of an Angel Investment/ Venture Capital funding opportunities for early-stage entrepreneurs. She said angel investors are wealthy private investors focused on financing small business ventures in exchange for equity. Unlike a venture capital firm that uses an investment fund, angels use their own net worth. Compared to venture capitalists, angels are also providing smaller amounts for a longer time period. But they do want to see an exit strategy at some point where they can pocket their profits, typically through a public offering or an acquisition. Angel investment is usually reserved for established businesses beyond the startup phase. These companies have shown promise for profits, but still need capital to develop products or grow. She further added that the angel investors typically want 10% to 50% of the company in exchange for funding. It’s important to think about how much equity the company want to give away to an investor for funding. The students asked many questions and it was answered by the resource person.